Fiscal Policy Discussion Notes

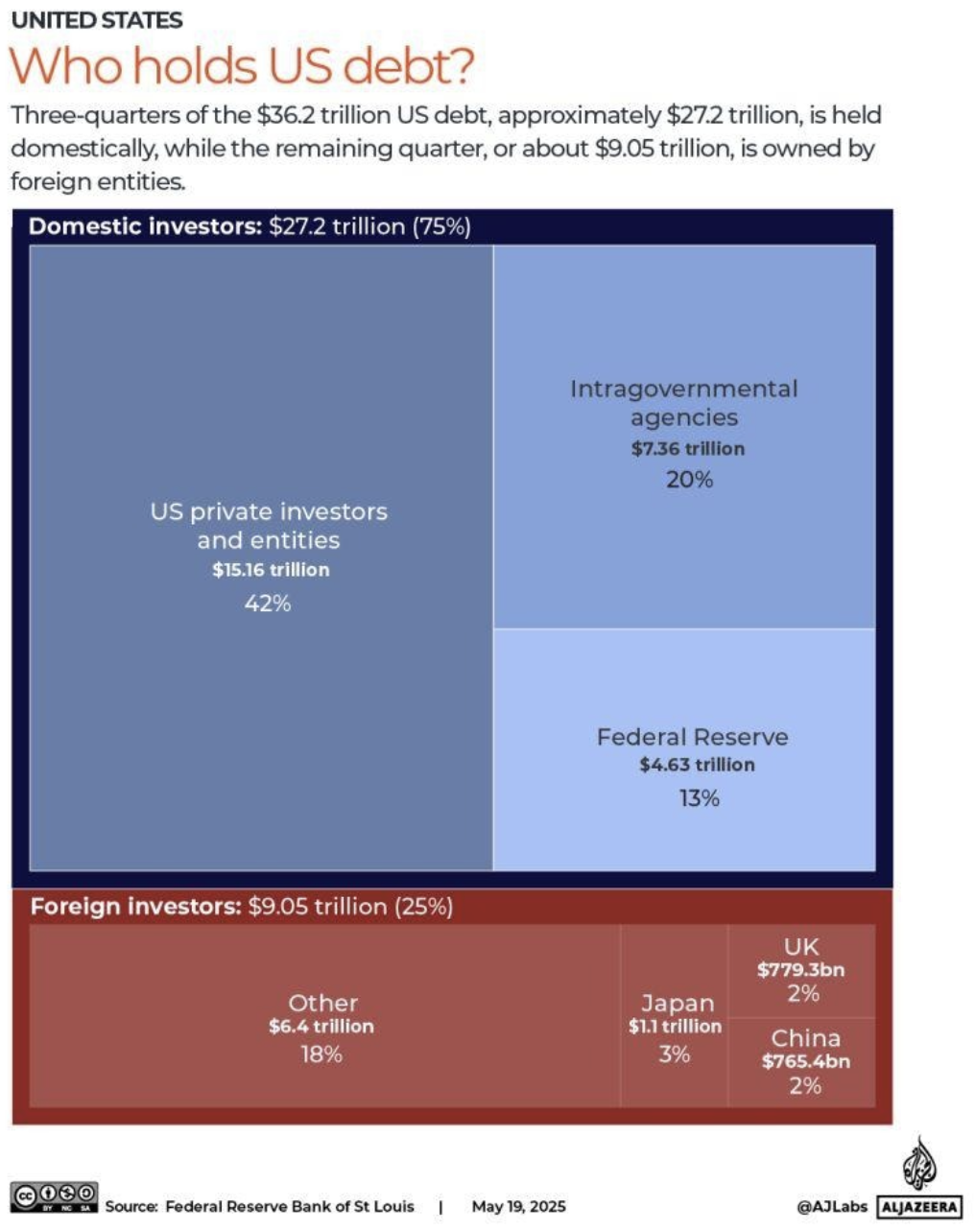

Infographics - Who Owns US Debt?

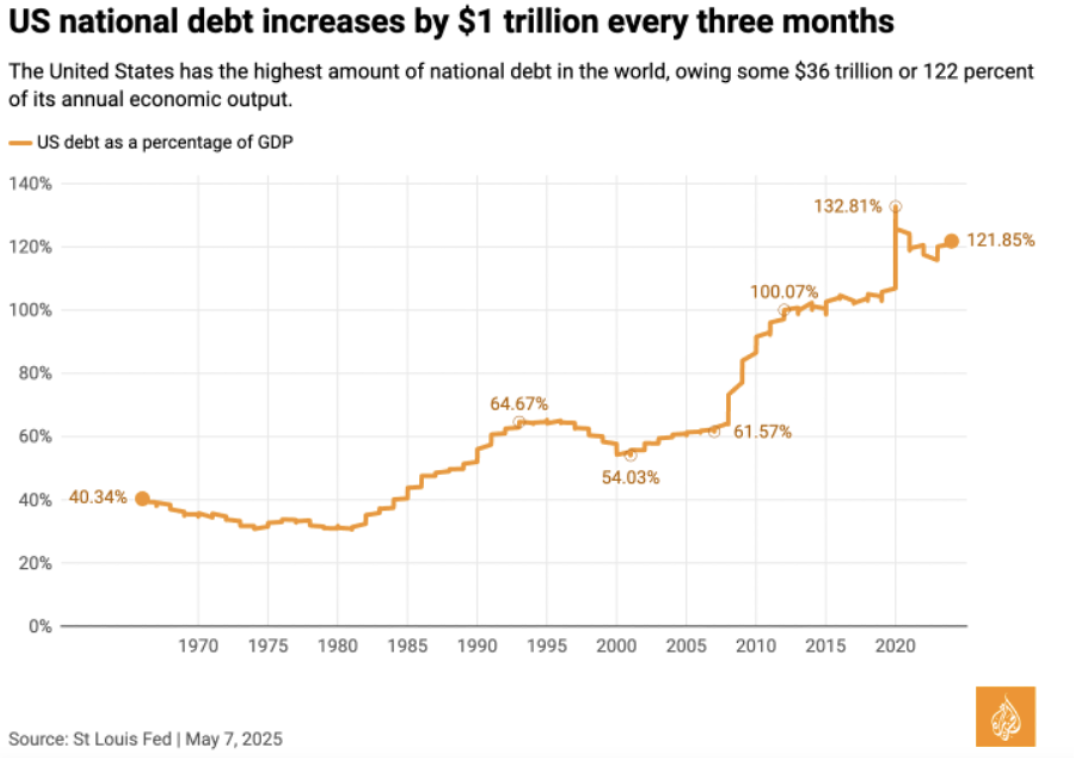

How Big Is The Debt (Relative To GDP)?

Is there a debt/GDP ratio that’s too high?

And is the answer to the above question contingent upon who holds the debt?

How does the role of the U.S. dollar as global reserve currency affect the answer to the above question?

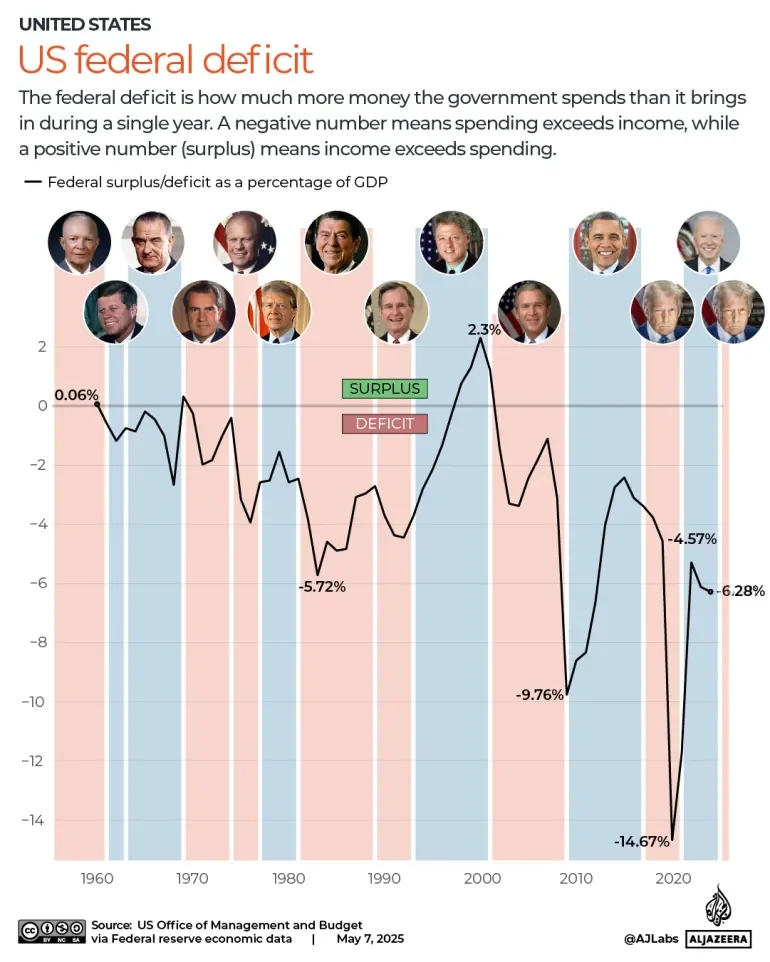

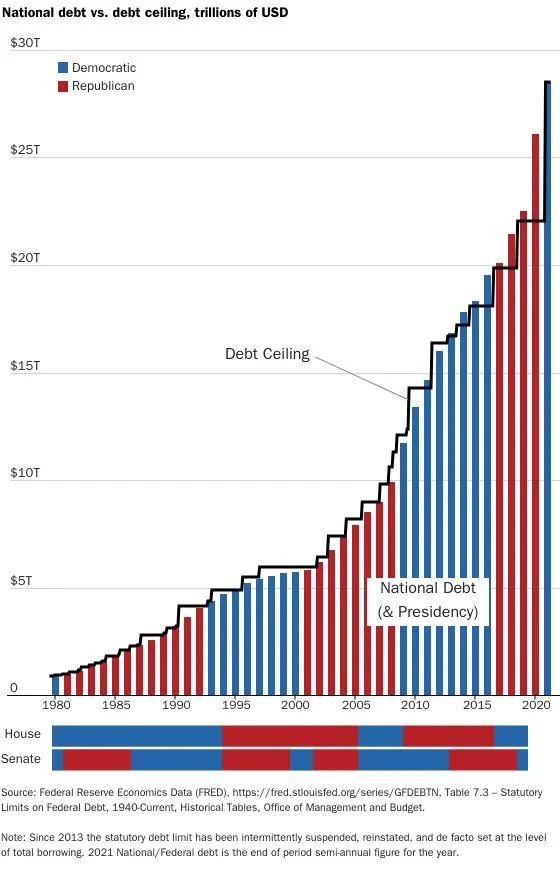

Does It Matter Who’s In The White House?

What are the political implications of cutting federal expenditures?

Why has neither party cut the debt?

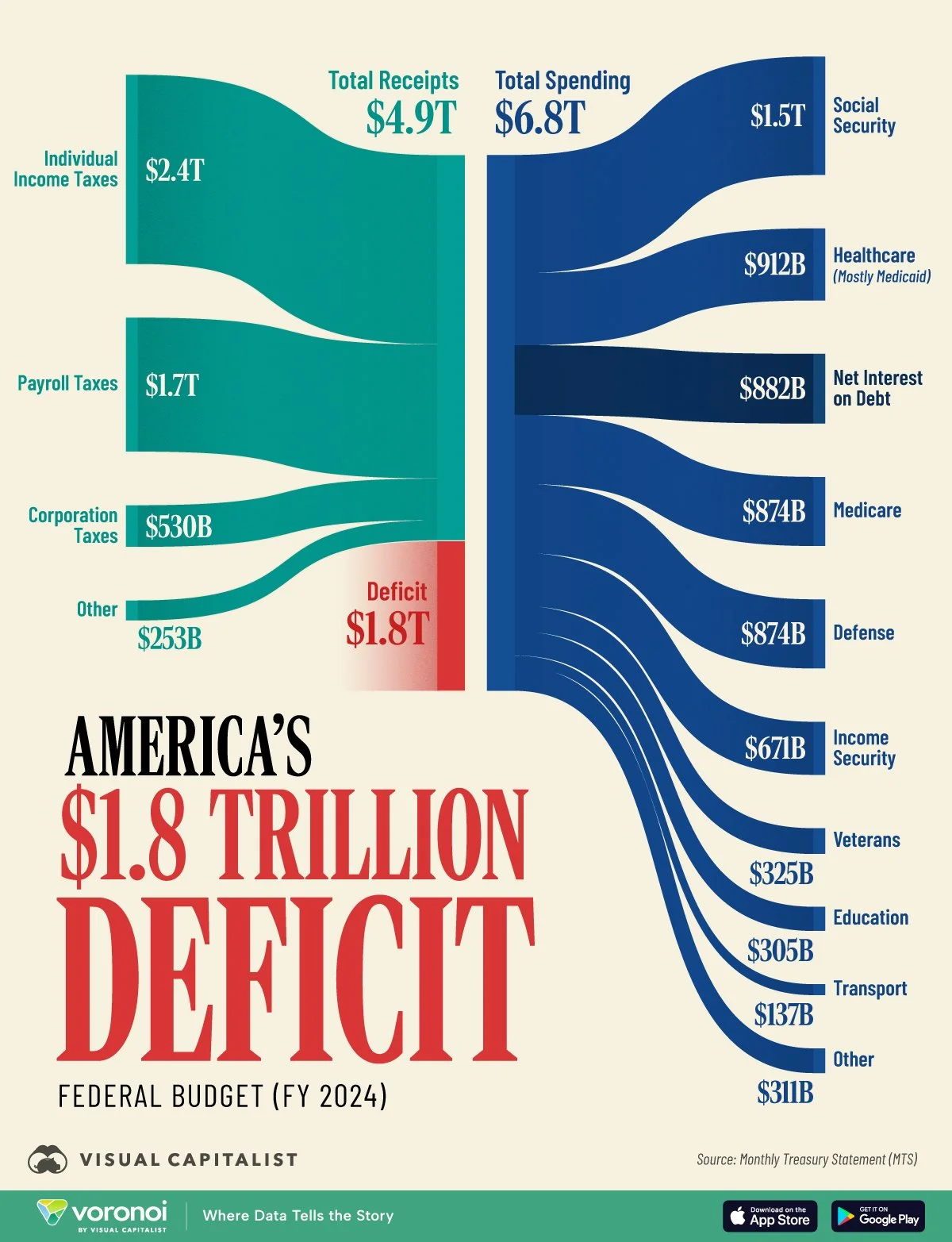

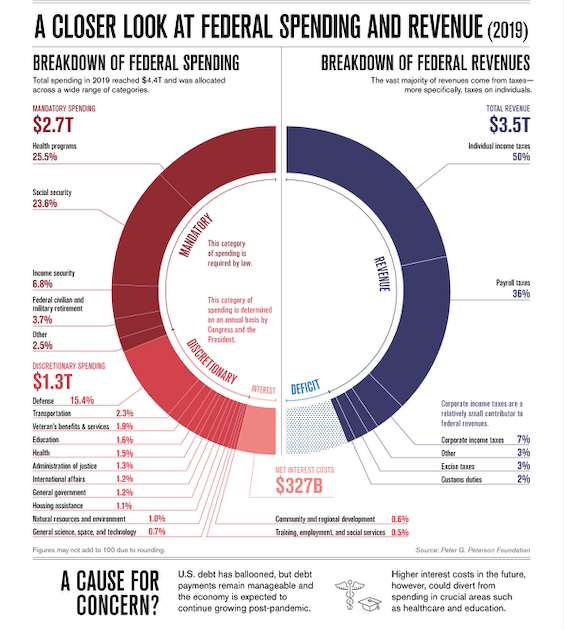

What Does The Federal Government Spend Money On?

Mandatory vs. Discretionary Spending

What expenditures, if any, should be cut to address the debt? Should any be increased?

How Do U.S. Federal Government Expenditures Compare To Other Countries?

What expenditures, if any, should be cut to address the debt? Should any be increased?

**Note: This graph includes both federal and local government expenditures on education.

The U.S. Debt Ceiling

The debt ceiling was first implemented in 1917.

It has been increased over 70 times since implementation.

It current stands at $41.1 trillion. It was raised to this level by Trump’s “Big Beautiful Bill Act”.

Should the debt ceiling exist? [Professor Buiter has argued ‘no’.]

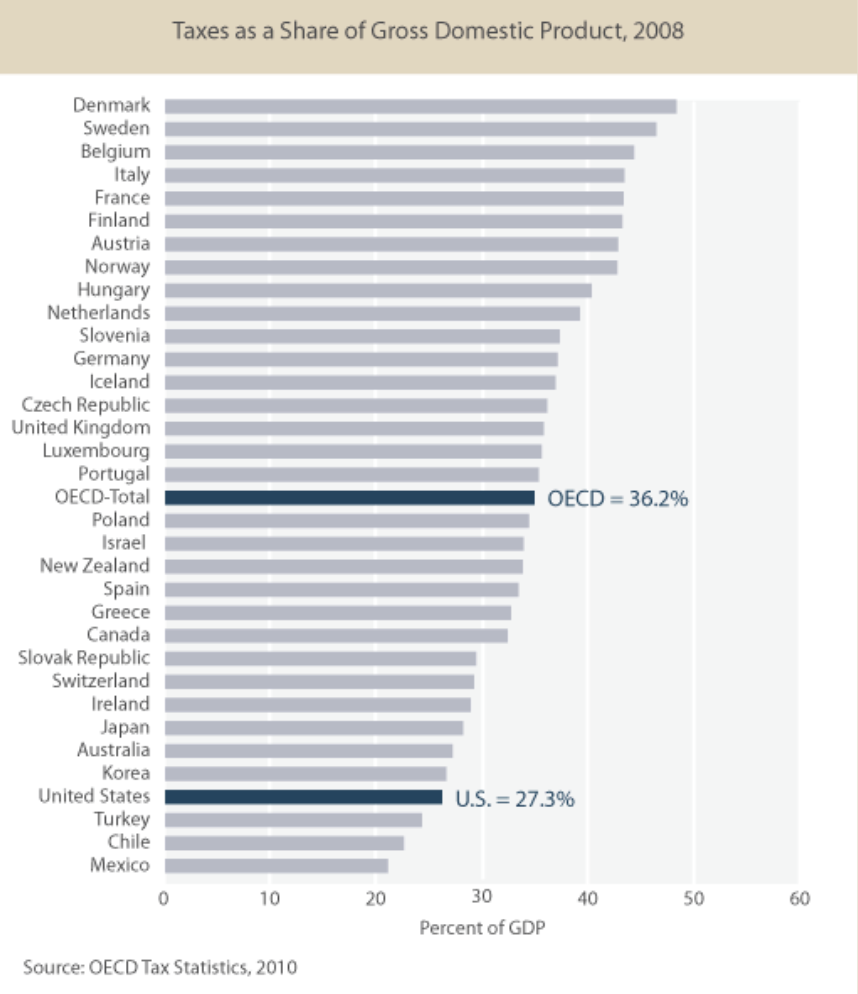

Comparative Tax Burden

Does this tax burden need to rise to address the debt?

Professor Buiter has argued ‘yes’.

Has The U.S. Ever Defaulted On Its Debt?

Per this report from the U.S. Congressional Research Service, the federal government has failed to make payments on time in multiple instances during its history.

A notable instance is missing bond payments to creditors in Philadelphia and Boston in 1814 as the War of 1812 was underway. America’s fiscal difficulties at the time prompted Treasury Secretary Alexander Dallas to write in a November 1814 letter that the “treasury was suffering from every kind of embarrassment”.

Report

Following the discussion, we will be circulating a report about the areas of consensus, areas of disagreement, and the proposed solutions amongst our policy-making and academic contacts.

Contributors

Mark Blyth

Professor of International Economics & Professor of International and Public Affairs, Brown University

Former Member of the Monetary Policy Committee of the Bank of England, Former Global Chief Economist at Citigroup, & former Professor at the London School of Economics,

Former Prime Minister, Finance Minister, & Foreign Minister of Montenegro

Jacob Soll

MacArthur Genius Award Winner & University Professor of Philosophy, History, & Accounting at University of Southern California (USC).

Lecturer of History, Rutgers University

Professor of Economics, Hofstra University

Francesco Brindisi

New York City Executive Deputy Comptroller for Accountancy, Budget, & Public Finance

Contributors’ Previous Takes On U.S. Federal Government Debt

Mark Blyth

Professor Blyth argues that the U.S. deficit discourse is largely driven by ideology rather than rigorous macro-analysis.

He rejects the “government as household” analogy, emphasizing that public deficits create private-sector surpluses and often finance investment rather than waste.

Professor Blyth has argued that high public debt is not automatically a crisis. Its sustainability depends on the structure of financing, interest rates, growth conditions, and who holds the debt—not on the raw debt-to-GDP ratio.

He has consistently rejected austerity as a solution to high debt, arguing that it often reduces growth and worsens debt ratios.

Robert Guttmann

Professor Guttmann places the accumulation of debt into broader dynamics of financialization, global imbalances, and systemic risk.

He argues that the U.S. currently plays the role of global consumer and global borrower, while surplus countries act as global savers and lenders.

The U.S. current account deficit means that money flows out of the U.S. to pay for foreign goods.

China, Japan, South Korea, Germany, and oil exporters accumulate dollar reserves and therefore need safe, liquid, interest-bearing U.S. dollar denominated assets. They invest heavily in U.S. Treasuries, corporate bonds, and agency securities.

The result is that the dollars accumulated by surplus countries are recycled back into the U.S. via investment in dollar-denominated U.S. assets.

These foreign inflows push down U.S. real interest rates creating an expansionary effect on the broader economy. They reduce mortgage rates, result in an expansion of consumer credit, and boost consumption (even if real wages stagnate).

The result: the U.S. becomes global consumer of last resort.

However, this system is fragile: a loss of confidence in the dollar’s reserve-currency role could force a contraction in U.S. consumption and generate severe global adjustment shocks.

Willem Buiter

Professor Buiter argues that the U.S. is on an unsustainable fiscal trajectory due to persistent large primary deficits and a chronically low tax burden among advanced economies.

He emphasizes that substituting borrowing for taxation can crowd out private investment.

He also argues that the debt ceiling is dangerous theater. He advocates abolishing it entirely, citing repeated brinkmanship and unnecessary market risk.

He suggests that the U.S. must raise taxes substantially to achieve sustainability.

Without major fiscal reform, he warns that the dollar’s reserve-currency role may erode, raising U.S. interest-rates.

Jacob Soll

Professor Soll emphasizes the importance of good public accounting, transparency, and institutional credibility. He focuses less on debt levels and more on the quality of fiscal governance.

In The Reckoning: Financial Accountability and the Rise and Fall of Nations, Professor Soll details instances of states rising when they maintain transparent, accurate, rigorous public accounts and declining when accounting standards decay, allowing misreporting, hidden liabilities, and fiscal denialism.

He offers the following cautionary lesson: good accounting alone cannot save a declining power, but bad accounting can accelerate decline.

Questions To Be Put To The Group

Severity of The Situtation

1. How concerned, if at all, should we be about the federal debt?

If it is a cause for concern, over what time horizon? Is this urgent?

How serious is the potential for a sovereign debt crisis?

2. Does Trump’s approach to international relations and tariff policy change the answer to question (1) in any way?

Is there a risk of a policy mistake triggering a crisis?

Is the U.S. at the mercy of bond markets? Is there a scenario where bond markets suddenly decide that the debt is an issue & trigger a crisis?

Interplay with U.S. Dollar Reserve Currency Status

3. What would be the implications of a sovereign debt crisis in the reserve currency country?

4. How might a growing debt burden affect the U.S. dollar’s role as global reserve currency, if at all, & how does the dollar’s role as global reserve currency relate to the government’s ability to continue accumulating debt?

[We will be organising a separate discussion in a few months on the U.S. Dollar standard. Here the focus is primarily on its interaction with the federal debt.]

Demography

5. How will demographic changes affect the debt?

Effect of Government Debt On Private Sector Investment

6. Economists talk about the ‘crowding out’ effect &, less often, the ‘crowding in’ effect. How might the growing U.S. debt load affect private sector investment?

Austerity

7. What, if anything, should be cut expenditure wise? Is austerity the solution?

Professor Blyth has argued that 1) we can’t all engage in austerity at once & 2) the boom, not the bust, is the time for austerity. So is now the time?

8. Can we grow our way out?

The ‘Government As Household’ Analogy

9. Is there a consensus among the group that the ‘government as household’ analogy is erroneous?

Public Accounting & Asset Management

[Professors Jacob Soll & Willem Buiter have co-authored a book on this topic].

10. Can improving public financial management have a significant impact on the debt/deficit? Would a proper accounting of the state’s balance sheet improve the situation?

11. How significant are the government’s unfunded entitlement liabilities? How would accounting for those alter the picture.

11. Many of the state’s public commercial assets are poorly managed or not accounted for at all. How much of an impact would properly accounting for/managing these assets make? Should these public commercial assets be sold off (privatised) or run by the state?

The Debt Ceiling

12. Is there a consensus amongst the group that the debt ceiling should be abolished?

Political Implications

13. What are the political implications of each proposed solution?