William Stanley Jevons’ A Brief Account of a General Mathematical Theory of Political Economy (1862)

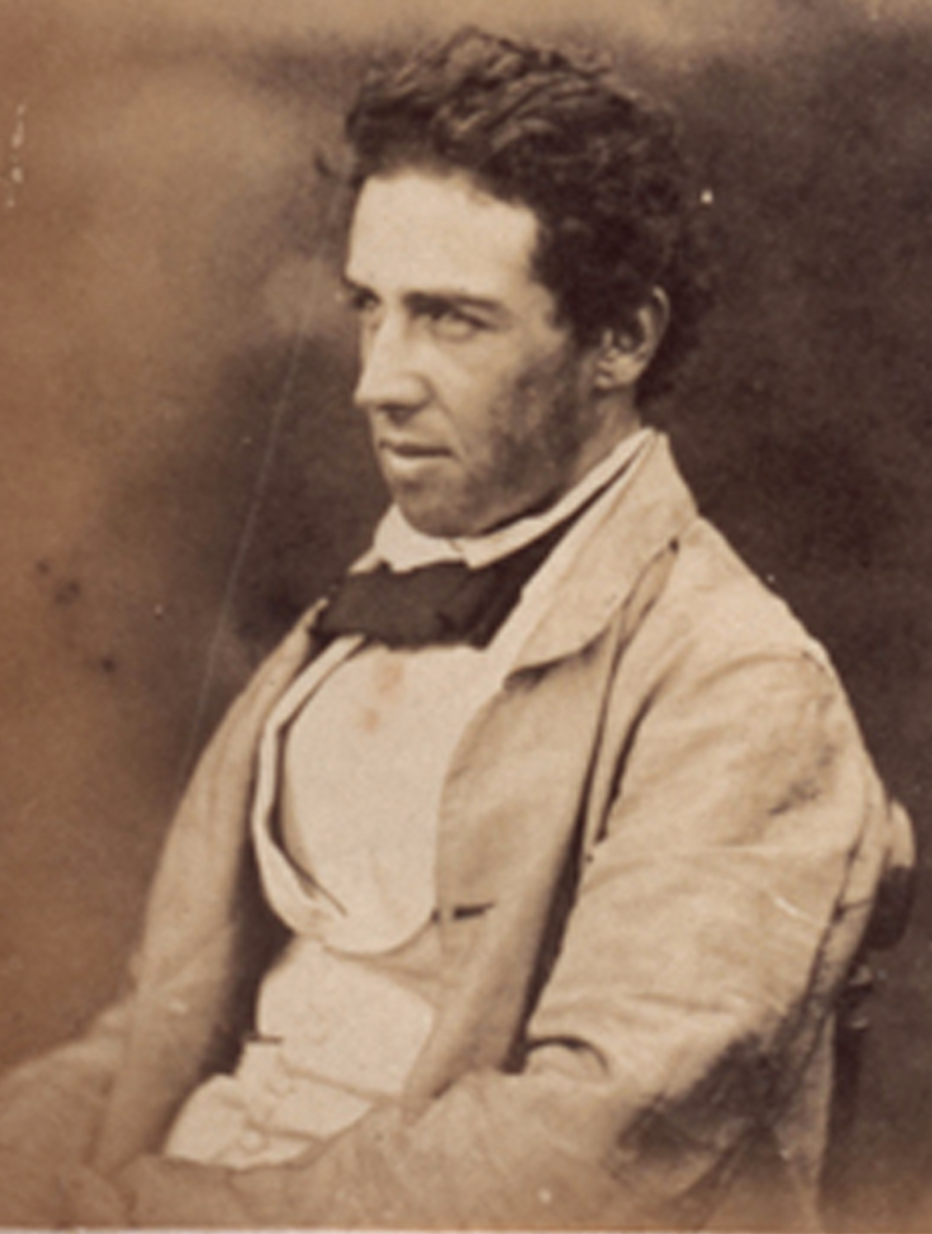

William Stanley Jevons in 1858.

Introduction

In 1862, aged only 26 or 27, William Stanley Jevons presented a paper to a meeting of the British Association that envisioned a radical transformation of the discipline of economics.

The paper, entitled A Brief Account of a General Mathematical Theory of Political Economy, advocated that economics make heavy use of mathematics.

It argued that the incorporation of mathematical techniques into the discipline would allow economists to explain virtually all economic activity by deductively reasoning from a basic theory of utility (see below).

The paper essentially constituted an early sketch of Jevons’ eventual magnum opus The Theory of Political Economy (1871).

But despite making similar arguments to those he would later articulate in his influential 1871 book, the antecedent paper was largely overlooked at this 1862 meeting.

Jevons would go on to publish the paper in the Journal of the Statistical Society of London in 1866.

Still, it gained little attention.

In 1871, Jevons published The Theory of Political Economy which elaborated his mathematized approach to economics.

The book’s first chapter fleshed out the arguments in favor of the mathematization of economics Jevons had sketched in his 1862 paper.

And its subsequent chapters articulated Jevons’ theory of utility and an intellectual edifice of economic theory that Jevons constructed upon it.

But, unlike the earlier paper, the book was heavily influential.

It was widely reviewed throughout England, with appraisals of Theory running in the pages of newspapers in London and Manchester.

And two of the most eminent economists of the age, Alfred Marshall and John Elliot Cairnes, published their own reviews of Jevons’ treatise.

Jevons’ book, coupled with the contemporaneous work of Leon Walras and Carl Menger, marked a turning point for economic thought: Jevons, Walras, and Menger would launch the marginalist revolution and set economics on the path toward becoming the heavily mathematical discipline it is today. (Related: Learn about the correspondences between Jevons and Walras on their efforts to transform economics.)

Jevons’ antecedent 1862 paper is therefore an important essay in the history of economic thought: its drafting was an early step in this revolution of the discipline.

This article breaks down the ideas a young Jevons articulated in his 1862 paper.

Economics Is Inherently Mathematical

Economics, Jevons argues, is inherently a mathematical discipline because it deals with quantities.

However, the powerful mathematical techniques which have been successfully applied to “most other sciences” have been neglected by economists.

The following paper briefly describes the nature of a Theory of Economy which will reduce the main problem of this science to a mathematical form. Economy, indeed, being concerned with quantities, has always of necessity been mathematical in its subject, but the strict and general statement, and the easy comprehension of its quantitative laws has been prevented by a neglect of those powerful methods of expression which have been applied to most other sciences with so much success.

Note here that Jevons writes of “quantitative laws” of economics which he believes mathematical techniques can illuminate. And he refers to economics as “this science,” before comparing it to “most other sciences,” which are mathematical.

The first paragraph of his essay therefore suggests that Jevons believed a mathematized economics would be a science capable of identifying unchanging laws which explain economic activity. Whether economics is, or is not, a science is today a topic of fierce debate amongst economists and philosophers.

(It should be mentioned that, although Jevons is advocating for the mathematization of the discipline, he makes no use of math in this paper, only sketching out his theory in words. The mathematized formulation of Jevons’ theory of economics is found in his subsequent 1871 Theory.)

Still, Economics is an Imprecise Discipline

However, Jevons writes, just because economics is a mathematical discipline, does not mean it is a precise discipline.

We can, in Jevons’ view, express relations between economic variables in a mathematical form.

But we will still be unable to use the equations so produced to arrive at precise conclusions about economic outcomes because we are unable to fill in the values of these variables.

It is not to be supposed, however, that because economy becomes mathematical in form, it will, therefore, become a matter of rigorous calculation. Its mathematical principles may become formal and certain, while its individual data remain as inexact as ever.

Pain & Pleasure

Jevons’ approach to economics begins with the idea that all economic activity is driven by a human desire to acquire pleasure and minimize pain.

According to Jevons’ theory of economics, this desire motivates the degrees to which we labor or leisure, consume or save, and so forth.

A true theory of economy can only be attained by going back to the great springs of human action -- the feelings of pleasure and pain. A large part of such feelings arise periodically from the ordinary wants and desires of body or mind, and from the painful exertion we are continually prompted to undergo that we may satisfy our wants.

Economy investigates the relations of ordinary pleasures and pains thus arising[.]

Economists, Jevons argues, should not consider all the motivations that spur human action: considerations such as morality and compassion are to be left to other disciplines.

Rather, economics should only consider how a desire to maximize pleasure and minimize pain motivate economic activity.

But economy does not treat of all human motives. There are motives nearly always present with us, arising from conscience, compassion, or from some moral or religious source, which economy cannot and does not pretend to treat. These will remain to us as outstanding and disturbing forces; they must be treated, if at all, by other appropriate branches of knowledge.

(Related: In 1844 John Stuart Mill made a similar argument in favor of economists separating out what he considered non-economic motivations, leaving them for consideration by other disciplines.)

Pain & Pleasure Can Be Quantified

Jevons proceeds to argue that a human’s pain and pleasure can be expressed as quantities, and therefore, compared. This, for Jevons, means that economists can treat then scientifically.

We always treat feelings as being capable of more or less, and I now hold that they are quantities capable of scientific treatment.

Revealed Preferences

How does an economist know when an individual has associated a greater degree of pleasure or pain with a particular decision (e.g. the decision on whether to labor an additional hour)?

The answer, Jevons argues, is revealed to the economist by decision the individual takes.

If the individual chooses to labor an additional hour, we know he calculated that the pleasure acquired by doing so (because of the additional output it will produce) exceeded the pain (from physical exertion, boredom, and/or other causes) of doing so.

Today’s economists would refer to the individual’s decision on whether or not to labor an additional hour, and the information it is, according to this theory, revealing to the observing economist, as the individual’s revealed preference. (Note that Jevons himself does not make use of this term.)

Our estimation of the comparative amounts of feeling is performed in the act of choice or volition. Our choice of one course out of two or more proves that, in our estimation, this course promises the greatest balance of pleasure.

“Quantity of Feeling”

Here Jevons makes his first mention of how mathematics, in particular integral calculus and simple arithmetic, comes into play in his economic theorizing.

The feelings humans experience in taking a particular course of action, Jevons writes, have two dimensions: intensity (i.e. how strong the feeling is) and duration (i.e. how long the feeling lasts).

If the intensity of the feeling is constant for the duration of time over which it is experienced, we may compute an individual’s “quantity of feeling” by multiplying the intensity by the duration.

And if the intensity of the feeling varies over the duration of time during which it is experienced, we would use integration to compute an individual’s “quantity of feeling.”

As several writers have previously remarked, feelings have two dimensions, intension and duration. A pleasure or a pain may be either weak or intense in any indivisible moment; it may also last a long or a short time. If the intensity remain uniform, the quantity of feeling generated is found by multiplying the units of intensity into the units of duration. But if the intensity, as is usually the case, varies as some function of the time, the quantity of feeling is got by infinitesimal summation or integration.

When making these calculations, pleasure is a positive quantity while pain is a negative quantity.

Pleasure and pain, of course, are opposed as positive and negative quantities.

Discounting

Anticipated future pleasure and anticipated future pain resulting from taking a particular action also cause us to feel pleasure and pain today.

But the intensity of this pleasure or pain experienced today is discounted owing to its remoteness and the possibility that it may not come to pass. (Jevons himself does not use the word “discounted” here, but this is the term today’s economists use to refer to this concept.)

A principle of the mind which any true theory must take into account is that of foresight. Every expected future pleasure or pain affects us with similar feelings in the present time, but with an intensity diminished in some proportion to its uncertainty and its remoteness in time. But the effects of foresight merely complicate without altering the other parts of the theory.

Diminishing Marginal Utility

At this point in the essay, Jevons begins to make use of the term “utility.”

Utility refers to the amount of pleasure an individual acquires from taking a particular action.

Amount of utility corresponds to amount of pleasure produced.

And he introduces an idea that economists today refer to as “diminishing marginal utility.” (Jevons does not make use of this modern phraseology in his essay.)

Marginal utility refers to the change in one’s utility from each additional unit of an item that is consumed.

Diminishing marginal utility refers to the idea that the utility (i.e. pleasure) an individual acquires from every additional unit of an object consumed, no matter how initially desirable or useful, diminishes.

For example, a first slice of cake may provide an individual with a certain measure of utility, but a second slice provides a reduced degree of utility, a 3rd slice provides less, a 4th slice even less, and so on. In fact, whereas the first slice of cake may have been enjoyable, after a certain point, additional slices may even elicit disgust.

[T]he continued uniform application of au useful object to the senses or the desires, will not commonly produce uniform amounts of pleasure. Every appetite or sense is more or less rapidly satiated. A certain quantity of an object received, a further quantity is indifferent to us, or may even excite disgust. Every successive application will commonly excite the feelings less intensely than the previous application. The utility of the last supply of an object, then, usually decreases in some proportion, or as some function of the whole quantity received. This variation theoretically existing even in the smallest quantities, we must recede to infinitesimals, and what we shall call the coefficient of utility, is the ratio between the last increment or infinitely small supply of the object, and the increment of pleasure which it occasions, both, of course, estimated in their appropriate units. The coefficient of utility is, then, some generally diminishing function of the whole quantity of the object consumed. Here is the most important law of the whole theory.

Jevons then clarifies that the rate at which the utility of each additional unit of an item decreases is specific to each item.

For example, the rate at which the utility gained by acquiring additional slices of bread diminishes is faster than the rate at which the utility gained by acquiring additional money diminishes.

The rate at which additional utility decreases is also specific to each individual.

For example, the rate at which the utility gained by acquiring more money decreases for one individual may be much faster than for another. That is, the first individual’s desire for money may be satiated much quicker than that of the second.

This function of utility is peculiar to each kind of object, and more or less to each individual. Thus, the appetite for dry bread is much more rapidly satisfied than that for wine, for clothes, for handsome furniture, for works of art, or, finally, for money. And every one has his own peculiar tastes in which he is nearly insatiable.

Reasoning Deductively from Simple Premises About Utility

It is from these simple premises – the assumption that all economic activity is motivated by a desire to maximize pleasure and minimize pain (with all other human motives being disregarded for the purposes of economic analysis), the idea that the pleasure and pain an individual feels from taking any action can be expressed numerically as what are called “utilities,” the idea that the future pain and pleasure associated with any action is discounted when taking the decision in the present, and the idea that marginal utility is diminishing – that Jevons devises his theory of economics.

From this starting point, Jevons reasons deductively to develop theories meant to explain essentially all economic activity. He constructs a theory of labor, a theory of rent, a theory of exchange, and a theory capital. And, while he does not elaborate on them in this short paper, he writes that his approach to economics is capable of accounting for “the effects of money, of credit, of combination of labor, of the risk or uncertainty of undertakings, and of bankruptcy.”

Note that Jevons himself does not explicitly write that this – reasoning deductively from a simple theory of utility – is what he’s doing. But it is the key to understanding the entire subsequent intellectual construct which Jevons articulates in this paper.

Written By: Aiden Singh Published: February 2, 2021