Economics & Finance

Explainers

Economics is the study of the production and allocation of resources by and amongst humans. It is concerned with what goods and services a society produces, how it produces them, and how they are allocated amongst the members of that society once they are produced.

Topics of interest to economists include central banking, money, exchange rates, international trade, economic development and poverty, debt and credit, the distribution of wealth, and the operation (and failure) of markets.

Finance, a sub-discipline of economics, is more narrowly concerned with how actors in an economy - individuals, businesses, and governments - raise, manage, and invest money and the channels through which money is directed from those with a financial surplus (e.g. people with savings or wealth) to those with a need to raise money (e.g. a new business that needs money to get off the ground).

Topics of interest to financial economists include financial markets, on which governments and businesses raise funds.

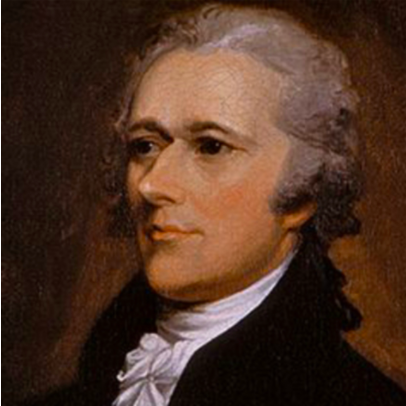

1806 Portrait of Alexander Hamilton by John Trumbull.

Alexander Hamilton

Learn about Hamilton’s plan for a national bank, his plan for the consolidation of states’ debts after the American Revolution, his articulation of the doctrine of implied powers, and his articulation of the infant industry theory of international trade.

By Aiden Singh

Related: Thomas Jefferson, Central Banking, American Revolution, Doctrine of Implied Powers, Infant Industry Theory of International Trade, Panic of 1792, Political & Economic Integration

1797-1811 Headquarters of the First Bank of the United States, Philadelphia.

Bank of the United States

Learn about America’s first central bank-like institution, a predecessor to today’s Federal Reserve, established at the behest of Alexander Hamilton.

By Aiden Singh

Related: Alexander Hamilton, Thomas Jefferson, Central Banking , Doctrine of Implied Powers

Behavioral Economics

Behavioral economics challenges the “Homo Economicus” model of human decision-making - which has long dominated economic orthodoxy - as a descriptive theory of human behavior.

By Aiden Singh

Friedrich Hayek.

Friedrich Hayek’s The Pretence of Knowledge

In 1974, as the world economy suffered a severe bout of stagflation, Friedrich Hayek was awarded the Nobel Prize in Economics. In his Nobel acceptance speech entitled The Pretence of Knowledge, he argued that the stagflation was caused by misguided Keynesian full employment policies. In making his critique of this policy, he restated several of the economic ideas with which he is most associated and provided his answers to some of the central questions in the philosophy of economics.

By Aiden Singh

Hyman Minsky.

Hyman Minsky’s Financial Instability Hypothesis

In a 1992 essay, Hyman Minsky expounded his financial instability hypothesis. According to Minsky’s theory, economic crises need not be the result of some exogenous shock to the economy. On the contrary, they may emerge endogenously as the very consequence of economic success. Minsky argues that periods of prolonged economic prosperity give rise to increased risk-seeking behavior, which in turn precipitate crises. In short, stability breeds its own instability.

By Aiden Singh

John Maynard Keynes.

John Maynard Keynes’ Economic Possibilities for Our Grandchildren

In 1930, as the world was in the grip of the Great Depression and the widespread scarcity it produced, John Maynard Keynes published an essay which prophesized about a coming age of abundance. Economic Possibilities for Our Grandchildren argued that, despite the pain of the Depression, humanity was on its way to overcoming what Keynes labeled the economic problem: the problem of needing to work to produce those necessities which sustain human life (e.g. housing, food).

By Aiden Singh

PredictIt’s 2020 U.S. presidential election prediction market on November 23, 2020.

Rational Choice Theory & Homo Economicus

The “Homo Economicus” theory of human behavior makes predictions about both how individuals will make choices under risk and how individuals will behave in strategic interactions. This theory of human behavior is based on the axioms of a more general theory of human behavior called rational choice theory.

By Aiden Singh

Saudi Riyals.

Saudi Arabian Riyal

Learn about the Saudi Arabian Riyal, the Saudi Arabian Monetary Authority (SAMA), and the Riyal peg.

By Aiden Singh

Singapore Dollar

Learn about the Singapore Dollar, the Monetary Authority of Singapore (MAS), and its exchange rate-centered monetary policy.

By Aiden Singh

Theory of Optimal Currency Areas

The Theory of Optimal Currency Areas considers the macroeconomic conditions that need to be met for two economics regions (e.g. two countries, two regions within a country) to successfully share a single currency.

By Aiden Singh

Related: Political & Economic Integration, Eurozone, US Dollar

John Stuart Mill.

When John Stuart Mill Cited William Stanley Jevons in the House of Commons

In an 1866 speech to the House of Commons, Member of Parliament John Stuart Mill argued that Britain’s diminishing reserves of coal meant that the then governing generation, and perhaps the next one or two, would be better positioned to pay off the national debt than subsequent generations. In making his case, Mill would cite William Stanley Jevons’ 1865 The Coal Question. The book, and the widespread attention it received, made Jevons famous several years before he published his magnum opus, The Theory of Political Economy (1871), which would set off the marginalist revolution and launch the transformation of economics into a mathematized discipline.

By Aiden Singh

William Stanley Jevons’ study while he lived in Sydney, Australia.

William Stanley Jevons (Timeline)

A timeline of William Stanley Jevons’ life, work, and ideas.

By Aiden Singh

William Stanley Jevons in 1858.

William Stanley Jevons’ A Brief Account of a General Mathematical Theory of Political Economy (1862)

In 1862, aged only 26 or 27, William Stanley Jevons presented a paper to a meeting of the British Association that envisioned a radical transformation of the discipline of economics. An early sketch of Jevons’ eventual magnum opus The Theory of Political Economy (1871), which would help launch the marginalist revolution, the paper argued that the incorporation of mathematical techniques into economics would allow economists to explain essentially all economic activity by deductively reasoning from a basic theory of utility.

By Aiden Singh